How to Buy a House Before Selling Yours

It sounds risky, buying a new house before selling your current one.

But is it a risk?

Are there benefits to buying a house before you’ve sold yours? What are the pros and cons to this home-buying strategy?

There are ways to put an offer on a house in this fashion, and we will review why many owners would stand to benefit, what problems may arise, and how you would go about doing it. Once we outline out how this works for your situation, we’ll examine how you can afford to pay for it and where you should get your down payment from. Say goodbye to making contingent offers, and hello to that new carpet smell!

How do you buy a house before yours has sold?

Maximizing your investment is always important when you are looking to move out of your old home and into a new home. Let's look at all the ways to get to your final destination before selling your old house, and see how each would impact you financially. In a competitive real estate housing market, a buyer should be making non-contingent offers on the homes that meet their needs. Otherwise, you can expect sellers to decline offer after offer because sellers will choose the surest thing available. Being able to count on a close of escrow date is a much better option than waiting for a buyer to sell their home. Making contingent offers is like asking a seller to accept a deal where you are the bottleneck. If a cash offer comes in, it's most likely game over for your contingent offer.

Know your options when it comes to buying before you've sold your home:

- Cash offer solutions are in high demand. Being able to make cash offers gives you an advantage when putting offers on homes. Cash will always be better than an IOU, so it's no surprise that these new companies are popping up all over the place. Who doesn't want to snag their dream home as soon as it hits the market? But what do the costs look like, and how is this accomplished?

- Sell, stay, and rent your home while you shop for your new home. This can be accomplished by the company purchasing your home from you for a fee or percentage of your home's value, plus the buyers' and sellers' closing costs or a % of the home's value. These two added together are the cost to get the cash or equity out of your home. Not located in all 50 states, this service's cost varies by state. For the sale of your second home and an additional set of closing costs, there is another fee that will be owed. The timing of this type of transaction is critical to making the 1 year's rent that you owe worth the cost. Yes, you have a 1 year lease on your home, but that buys you time to move.

- There are more direct approaches that give you your equity in installments that allow you to pay off your current mortgage while putting a down payment on a new one, using the first installment. Number two will come once your home is sold, and they will work with your agent to do so. There is a % fee taken from the sale of your home, along with costs incurred during the time that this company held your home. Unlike the first option, this only has one set of closing costs, and if you sell your home before you buy your new one (eliminating their need to buy your home), you can save yourself $. A drawback to this option is that less of your equity is required to play with for your new purchase.

- Apply for a separate mortgage on the new home. If you can meet the debt-to-income level of about 43%, this is an option for you. This is less common, as it is hard to achieve with an existing mortgage. You will need to specify whether the home is a second home or an investment property. To qualify for the second home option, it cannot be located close to your existing home, and you will need to spend half of the year there. There will also be a minimum FICO of 640 per Fannie Mae, and generally 20% or more is expected for the down payment. The interest rates may also be higher on a second home, so you'll most likely refinance once you sell your old home. Remember, with two homes you double your costs. Yes, that means two bills for insurance, maintenance, utilities, taxes, etc. Unless you are thinking about keeping your current home, this option doesn't make sense.

- Use a Bridge Loan. The equity built up in your current home is the bridge to your new home. This is what a bridge loan does for you. The Arrival Home Loan is a great example of this loan tool. What sets our bridge loan apart from the competition is that our loan is backed by private money. This gives the seller the certainty to close they are looking for, and cash-like buying power for you. You only pay the interest on the loan for as long as you hold the loan. Being a short-term loan, the full amount will come due in 11 months, which is why you always go in with a planned exit. For example, your exit could be a refinancing of the bridge loan with a conventional 30-year fixed loan once you sell your current home. Not only will you avoid moving twice, you'll give yourself time to ready your home for sale (staging). With time to stage and polish your home, you increase your proceeds by up to 17%. Most borrowers are out of the Arrival Home Loan within 3 to 4 months, thereby incurring the interest cost for only 3 to 4 months. Closing costs will definitely need to be covered, and you will need to qualify for an exit that gets you out of the bridge loan before the balloon payment is due. You will also need a minimum FICO of 680 and a max loan to value of 75%. Our borrowers who work to get out of their current home quickly are able to sell their home on the market (empty and staged), refinance, and end up in a profitable situation because of the order in which things were done.

- Using a home equity loan for a down payment on your new home. This will allow you to use the equity in your home; you receive it in one lump sum payment, and use it on the purchase of your new home. It's very important to note that not all mortgage lenders will allow you to use a home equity loan for a down payment. A home equity loan does put your property at risk because your home is used as your collateral, and if you still owe money on the first mortgage, any financial hiccup could have you in deep waters debt-wise. There is also the risk of a real estate market downturn, where your home value declines and you end up owing more than your home is worth. This loan does have a fixed rate, and can work if you need funding. Three sets of closing costs may be incurred if you plan on selling your original home.

- Getting cash from a family member. With the highest cost-saving potential, this option isn't a reality for a lot of us. In today's world, people have less and less cash on hand. The catch or the problem with this gift down payment from a family member is that you will still need to meet the debt-to-income level of about 43%; and if you have a second mortgage, this is hard to do.

- A cash-out refinance is a way to get a larger loan in exchange for cash. You are basically borrowing against your equity and increasing your monthly payment. With a typical maximum LTV of 80%, you will only be able to borrow the property value - 20%. After you figure out this value, the dollar amount will be used to pay off your first loan. You will receive the remaining proceeds as cash. Again DTI or debt-to-income level comes into play here as well because you need to be below the 43% with your new loan payment. An appraisal will be needed to verify your current home's value. Three sets of closing costs may be incurred if you plan on selling your original home.

With so many options, you need to evaluate your financial situation, and to match it with the best solution for you. Each has its trade offs, but each provides you with a vehicle into your new home before selling yours. Selling your home at the same time as you are looking to move is beyond stressful. Rocket Mortgage described it best.

"It's like playing a game of mortgage chicken."

Avoiding mortgage chicken is possible, so let's take a deeper dive into the options above.

What are the cons of buying a house before selling?

The Costs:

Each option above has its trade offs for making the buying before selling tactic a reality.- You'll need to first determine how much time you will need to move out of your old home. Do you need a full year? If not, then maybe having a company buy your current house from you won't be the right choice because you don't want to pay for a full year of rent.

- Maybe you want the maximum equity you have to play with. If that is the case, you will also skip this option. A lot of these Power Buyers are paying an average of 92% of value for your current house.

- If you think selling your current house will take longer than 11 months, a bridge loan would not be a good option for you because it comes due in 11 months. Buying before selling is simplified with a bridge loan, but there is a sense of urgency to leaving your home since bridge loans typically have higher interest rates. The sooner you get out of your home, the less costs you incur.

- Buying a second home means double the costs. That means two sets of property taxes, utility bills, maintenance, etc. Your interest rate will most likely be higher as well, which means you may want to refinance. This leads to three sets of closing costs to facilitate the buying, selling, and refinancing of your new home.

- Getting cash out or borrowing against your equity will increase your monthly mortgage payment.

- Closings costs could occur anywhere from 1, 2, or 3 times depending on the financing path that you choose.

-

Choosing a cash-out refinance will require 3 sets of closing costs.

-

When looking at all of these options, you cannot forget the capital gains tax that is involved with selling your home. Being excused from reporting the sale of your home would mean you meet

3 conditions: your gain is less than $250,000, you have not used the exclusion in the last 2 years, and you have owned and occupied the home for at least 2 years. Otherwise, this burden becomes something you budget for in your taxes the following year.

Debt-to-income ratio requirements (DTI):

The requirement is calculated by taking all your monthly debt payments and dividing them by your gross monthly income. This percentage needs to be lower than 43% when adding in your new monthly payments for buying your new home. If you are over this number, it will be difficult qualifying for a mortgage. This makes buying before selling via a second mortgage or cash-out refinance a bit more challenging.

Risk:

All loans have varying levels of risk, so each path has its own risk. Underwriting's goal is to minimize risk, and they evaluate your financial stability and assets to assign a level of risk to you when reviewing your loan application. If the loan you are applying for is a 2nd, such as a home equity loan, this puts the lender in second position. This means that if you default on the loan, they will be paid after the first loan is paid off with whatever remains from the foreclosure sale of your home.

How much money should you put into a house before selling?

Do you have a friend that sees every flaw? If so, invite them over to do an honest home evaluation. Use a premade list to pull the items from, like this one. The goal is to make a note of the condition of your home, so we can prioritize the renovations by cost, and the return on each. You'll be surprised at the power of a deep cleaning, new neutral paint, light landscaping, and fixing those little things around the house that you just haven't had time to get around to. All of these items are definitely low-hanging fruit.

That means that if you have a bad roof and cost to fix it is $9,000, the potential buyer will likely subtract an estimated $18,000 from their offer.

Given these considerations, how much money should you put into a house before selling? Well, if you are looking at a shorter timeline, you'll want to focus on cosmetic repairs. Painting, landscaping, deep cleaning, popcorn ceilings, etc. This is a great list that features 8 cosmetic repairs a buyer can easily fix after buying.

As a seller, if you completed all of these 8 cosmetic repairs and you received a complete home inspection that was free of needed additional repairs, let's look at the cost breakdown of a 2000 square foot home, with a 55 square foot kitchen.

| Furniture & Decor (staging) 2,000-square-foot home would cost around $2,000 to $2,400 a month | $7200 for 3 months |

| Wall Color (painting) average cost of $3.50 per square foot | $7000 for 2000 square foot home |

| Flooring install Hardwood flooring | $16,000 ($4 plank flooring + $4 labor) $8 x 2000 = |

| Countertops new countertops estimates | $2200 |

| Cabinets cost to refinish cabinets | $2,975 |

| Appliances (new dishwasher) replace what you need to | $600 |

| Popcorn Ceilings (removal cost per National average) | $1000 |

| Home Inspection - home inspection ranges between $260 – $630 in California | $430 |

| Landscaping (light) | $2600 |

| Total | $40,005 |

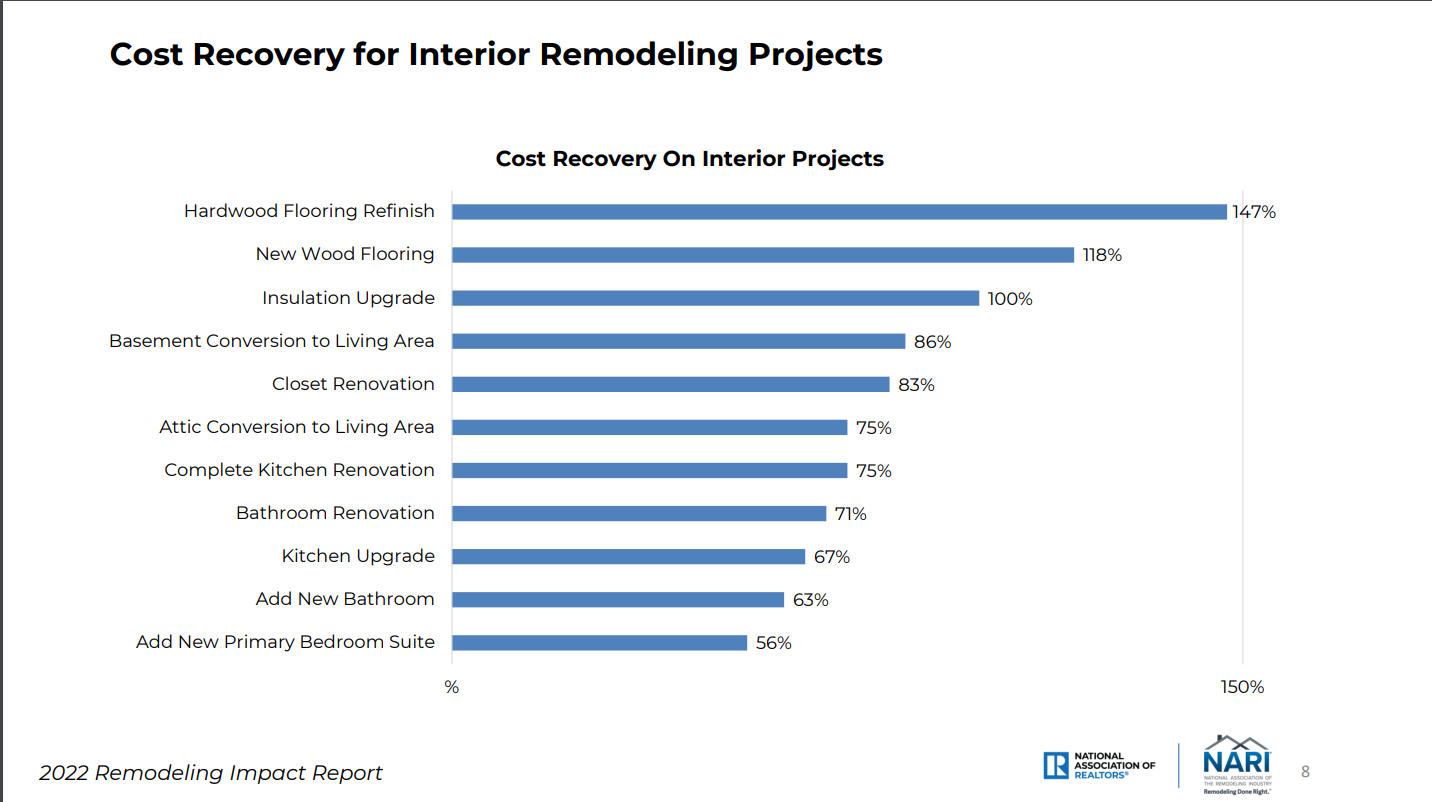

Okay, so that's a pretty big chunk of change, and you want to make sure you recover as much of the cost as possible. Below is an image depicting the cost recovery for interior remodeling projects. We should definitely keep the new wood flooring and landscaping because they both return over 100%, so that puts us at $18,600. The popcorn ceilings are a given, along with the home inspection. Now at $20,030, do you have purple walls? If not, and they are already neutral, we can shave off this chunk and opt for a deep cleaning instead. For a 2000 square foot home, that will run us on average $415. With our total at $20,445 to include our deep cleaning, staging is also a must because of the possible 17% increase to our purchase price. So that is another $7,200, which brings us to $27,645. For the remaining costs on this list, you might want to pass on selecting them all because they all net you 75% or below; and since you did not plan on doing a full upgrade, they will be below 75%. Countertops would definitely make a big impact, and can revitalize the kitchen space. We are now at $29,845.

Source: https://cdn.nar.realtor//sites/default/files/documents/2022-remodeling-impact-report-04-19-2022.pdf

Source: https://cdn.nar.realtor//sites/default/files/documents/2022-remodeling-impact-report-04-19-2022.pdf

In theory we can subtract the costs that are going to be recovered, bringing us back down to $11,245. With the increase in purchase price of a possible 17% from staging and the other cosmetic improvements also adding up in our favor, we didn't leave very much for the potential buyer to knock off their offer.

Readying your home for sale in a cost-efficient way will leave you with more money to cover other expenses like earnest money, capital gains tax, property tax, mortgage insurance, and more fun new home ownership costs. We jest, but all the costs that go into buying and selling homes add up. By investing in cost-efficient cosmetic repairs for your home before selling, you can avoid receiving low offers from potential buyers. These repairs can significantly increase the value of your home and make it more appealing to buyers, ultimately resulting in a higher offer. Plus, by focusing on cosmetic repairs rather than major renovations, you can keep costs low and maximize your return on investment. So, don't let a low offer catch you off guard – take the initiative to make your home as attractive as possible to potential buyers.

Apply for an Arrival Bridge Home Loan today

One of the options we explored today is applying for an Arrival Home Loan, which allows you to purchase a new home before selling your current one, relieving the stress of timing both transactions. There is no need to play mortgage chicken when you don't have to! Our streamlined application process makes it hassle-free, but it is crucial to seek guidance from a trusted mortgage advisor, as well as a financial advisor, to determine the best choice for your situation. Take your time to explore all your options, and let's work together to make your dream home a reality.